Tax

Our lawyers bring to the table significant experience in implementing complex tax planning strategies for businesses of all sizes. They regularly work with accountants, including firms across Canada and internationally, as well as with our clients’ trusted advisors, to ensure the business is operating on a tax-efficient basis. Our nationally recognized experience includes advising on:

- Income tax

- Excise tax

- GST/HST

- Capital tax issues

- Cross border issues

- Corporate and personal tax planning

- Tax planning for executive compensation

Our lawyers also have significant experience in successful appeals at the Tax Court of Canada. They regularly handle our clients’ issues with the Canada Revenue Agency regarding issues of assessments, audits, and demands for information.

Insights

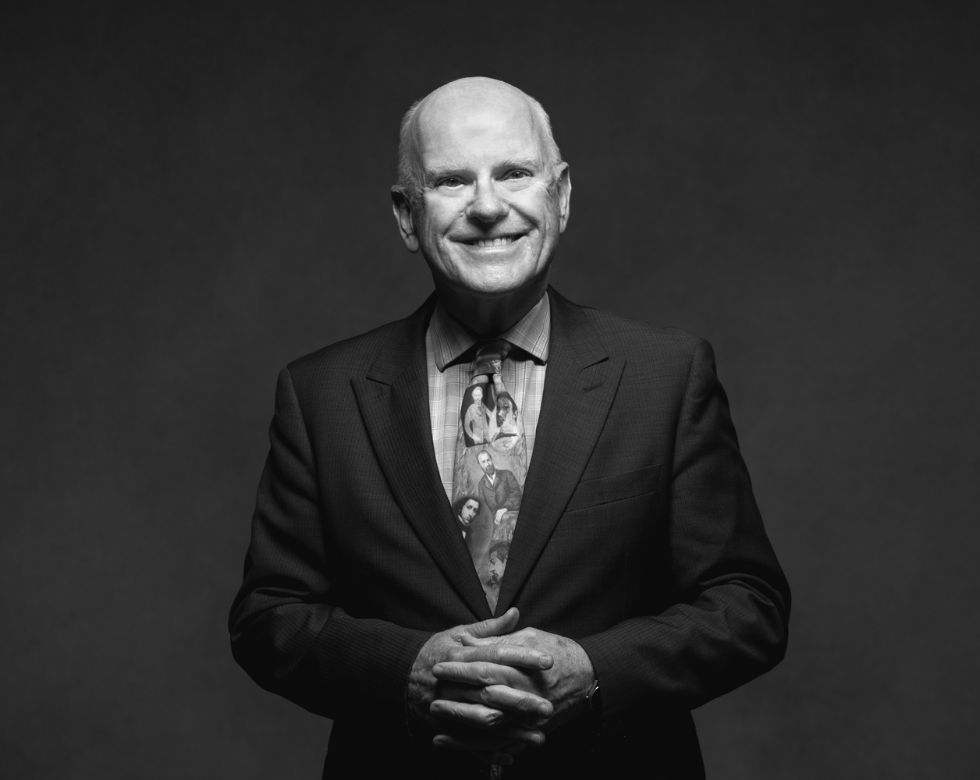

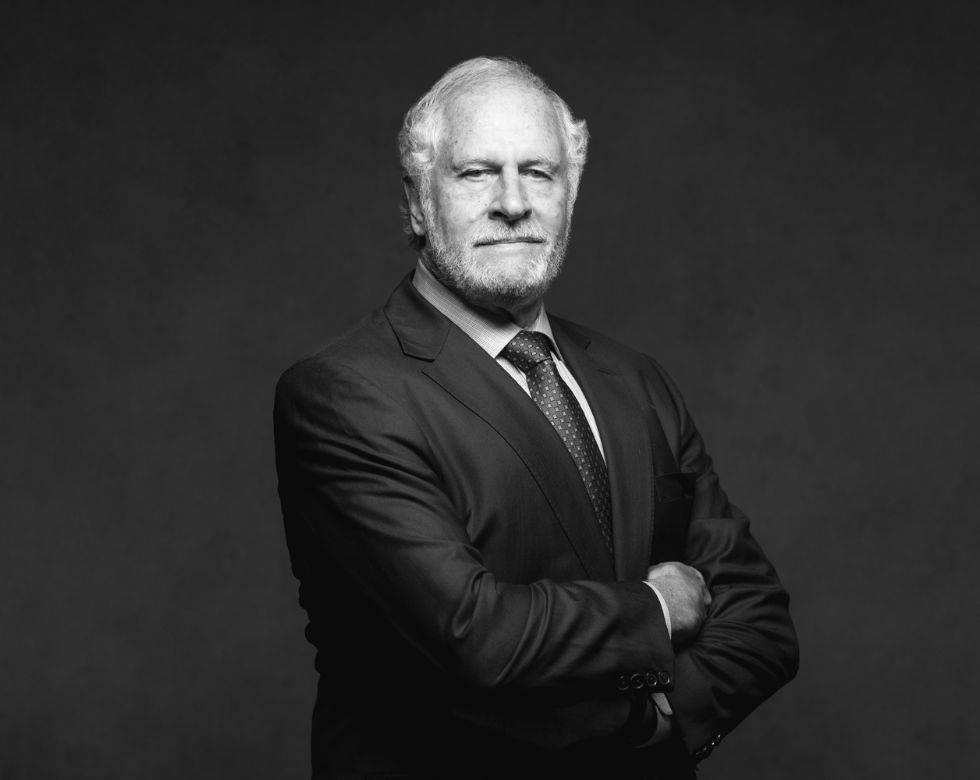

Associated Lawyers

- All

- Charlottetown

- Fredericton

- Halifax

- Saint John

- St. John's