Nova Scotia setting legislative framework for green hydrogen

Sadira Jan, Dave Randell, and James Gamblin

On October 17, 2022, the Government of Nova Scotia tabled bills that would amend four pieces of legislation in support of future green hydrogen development.

The intended impacts of the proposed amendments are outlined below:

| Legislation | Impact of Amendments |

| Electricity Act | Expands the definition of “wholesale customer” to include the owner or operator of a “hydrogen facility” that is advancing green hydrogen projects. To date, the only permitted wholesale customers under the Electricity Act are Nova Scotia Power Inc. and municipal utilities. The amendment also provides the that Minster will create a Hydrogen Innovation Program which will allow for the interconnection of a hydrogen facility to the electrical grid. |

| Gas Distribution Act | Allows the Nova Scotia Utility and Review Board to consider hydrogen as part of a gas distribution system under the Gas Distribution Act. |

| Pipeline Act | Amendments add pipelines built for hydrogen or hydrogen blends. |

| Underground Hydrocarbons Storage Act |

Expands the scope of the Underground Hydrocarbons Storage Act to include hydrogen, ammonia, carbon sequestration and compressed air energy storage |

In the House of Assembly, the Minster of Natural Resources, indicated that further regulatory amendments intended to support and regulate green hydrogen development will be forthcoming. The Minister has committed to the release of a green hydrogen action plan in 2023.

Green hydrogen is hydrogen produced through clean renewable energy sources such as wind. On October 12, 2022, the Impact Assessment Agency of Canada released, for public comment, draft agreements between the Federal Government and the governments of Nova Scotia and Newfoundland and Labrador, in connection with Regional Assessments in each province for offshore wind development. Draft Terms of Reference for both Regional Assessments were also released for public comment. The comment period for these documents ends on November 26, 2022.[1]

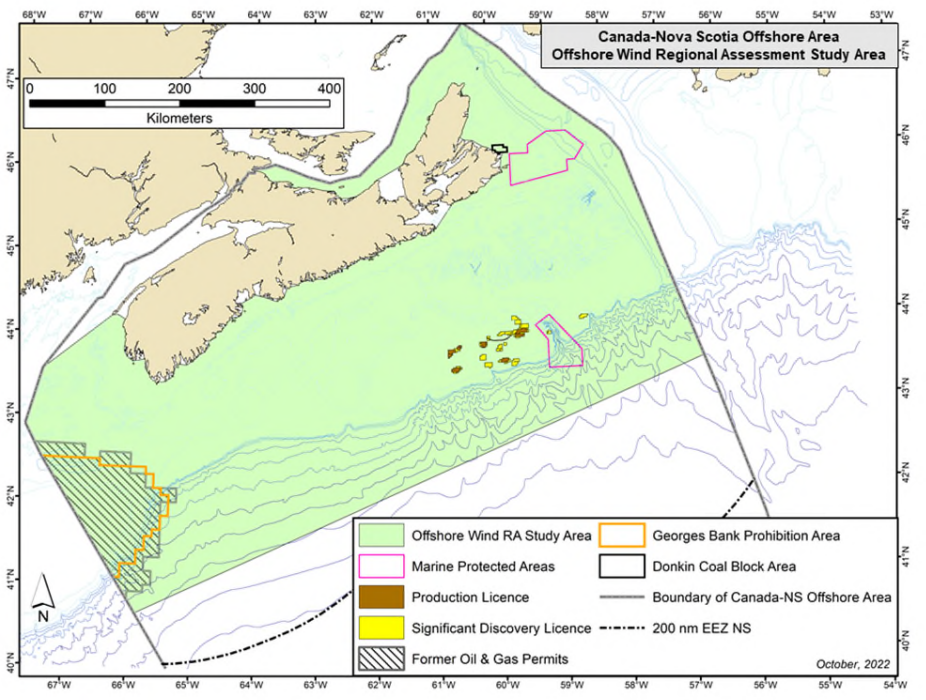

Below are the proposed study areas for each Regional Impact Assessment[2]:

For more information on the offshore wind Regional Assessments, please see our previous Thought Leadership piece, “Federal Government, Nova Scotia, and Newfoundland and Labrador clearing the way for offshore wind development”.

Sadira Jan is a partner in the Halifax office, with a practice focusing on renewable energy, financing transactions, mergers and acquisitions, as well as general corporate law. Sadie has extensive experience acting as lead counsel for onshore wind development projects and acts in the development, implementation and testing of tidal power in Atlantic Canada. She has been recognized by Lexpert in Energy law (electricity).

Dave Randell is a partner in the Halifax office, with extensive experience across various industries including energy, insurance, mining, media, manufacturing and technology. He has acted as lead advisor for a number of noteworthy Canadian and international clients in the energy sector.

James Gamblin is an associate in the Halifax office, with a practice in the areas of renewable energy, leasing, mergers and acquisitions and general corporate law. Jamie’s practice focuses advising clients regarding legislative and regulatory compliance. Jamie has a policy background, and holds Master’s degree in Public Policy and Public Administration.

This update is intended for general information only. If you have any questions on the above we would invite you to contact the authors or any other member of our Energy Group.

Click here to subscribe to Stewart McKelvey Thought Leadership.

[1] Impact Assessment Agency of Canada, “Public Notice: Regional Assessment of Offshore Wind Development in Newfoundland and Labrador and Nova Scotia.” Online: https://iaac-aeic.gc.ca/050/evaluations/document/145237?culture=en-CA

[2] Impact Assessment Agency of Canada, “Draft Agreement – Newfoundland and Labrador”, online: https://iaac-aeic.gc.ca/050/evaluations/document/145234?&culture=en-CA; Impact Assessment Agency of Canada, ”Draft Agreement – Nova Scotia”, online: https://iaac-aeic.gc.ca/050/evaluations/document/145235?&culture=en-CA

Archive

Included in Discovery: Atlantic Education & the Law – Issue 12 By Dante Manna[1] Once known for recreational use, psychedelics are slowly gaining medical legitimacy as research emerges on possible therapeutic benefits for mental health…

Read MoreWe are pleased to present the twelfth issue of Discovery, Stewart McKelvey’s legal publication targeted to educational institutions in Atlantic Canada. Our lawyers provide insight on a number of topics facing universities and colleges including…

Read MoreBy Kyle S. Hartlen, Gavin Stuttard, and Colton Smith What is the Innovation Equity Tax Credit? The Nova Scotia Innovation Equity Tax Credit (“IETC“) is a non-refundable personal and corporate income credit intended to encourage…

Read MoreBy Deanne MacLeod, K.C., Burtley G. Francis and David F. Slipp In June 2022, Canada’s federal government enacted a number of changes to the Competition Act (the “Act”) as the first step in a comprehensive…

Read MoreThis article was updated on April 19, 2023. By Mark Tector and Ben Currie On April 12, 2023 Bill 256: Patient Access to Care Act received Royal Assent. Schedule B of the Bill is the…

Read MoreThis Thought Leadership article is a follow-up to our January 2023 article on the introduction of the Prohibition on the Purchase of Residential Property by Non-Canadians Act. By Brendan Sheridan On January 1, 2023, the…

Read MoreBy Kevin Landry and Jahvon Delaney Background On March 25, 2023, the Government of Canada released a Notice of Intent titled Consultation on potential amendments to the Cannabis Regulations. The Notice outlines that Health Canada is…

Read MoreBy Kimberly Bungay On April 1, 2023, the Nova Scotia government will proclaim into force Bill 226, which amends the Companies Act (the “Act”) to require companies formed under the Act to create and maintain…

Read MoreBy Chad Sullivan and Kathleen Starke Background A recent decision, Vail v. Oromocto (Town), 2022 CanLII 129486, involved several grievances including an unjust dismissal claim by a firefighter as well as a grievance filed by…

Read MoreBy Stuart Wallace and Kim Walsh On January 1, 2022, the Underused Housing Tax Act (the Act) took effect. The Underused Housing Tax (the UHT) is an annual 1% tax on the value of vacant or…

Read More