Nova Scotia setting legislative framework for green hydrogen

Sadira Jan, Dave Randell, and James Gamblin

On October 17, 2022, the Government of Nova Scotia tabled bills that would amend four pieces of legislation in support of future green hydrogen development.

The intended impacts of the proposed amendments are outlined below:

| Legislation | Impact of Amendments |

| Electricity Act | Expands the definition of “wholesale customer” to include the owner or operator of a “hydrogen facility” that is advancing green hydrogen projects. To date, the only permitted wholesale customers under the Electricity Act are Nova Scotia Power Inc. and municipal utilities. The amendment also provides the that Minster will create a Hydrogen Innovation Program which will allow for the interconnection of a hydrogen facility to the electrical grid. |

| Gas Distribution Act | Allows the Nova Scotia Utility and Review Board to consider hydrogen as part of a gas distribution system under the Gas Distribution Act. |

| Pipeline Act | Amendments add pipelines built for hydrogen or hydrogen blends. |

| Underground Hydrocarbons Storage Act |

Expands the scope of the Underground Hydrocarbons Storage Act to include hydrogen, ammonia, carbon sequestration and compressed air energy storage |

In the House of Assembly, the Minster of Natural Resources, indicated that further regulatory amendments intended to support and regulate green hydrogen development will be forthcoming. The Minister has committed to the release of a green hydrogen action plan in 2023.

Green hydrogen is hydrogen produced through clean renewable energy sources such as wind. On October 12, 2022, the Impact Assessment Agency of Canada released, for public comment, draft agreements between the Federal Government and the governments of Nova Scotia and Newfoundland and Labrador, in connection with Regional Assessments in each province for offshore wind development. Draft Terms of Reference for both Regional Assessments were also released for public comment. The comment period for these documents ends on November 26, 2022.[1]

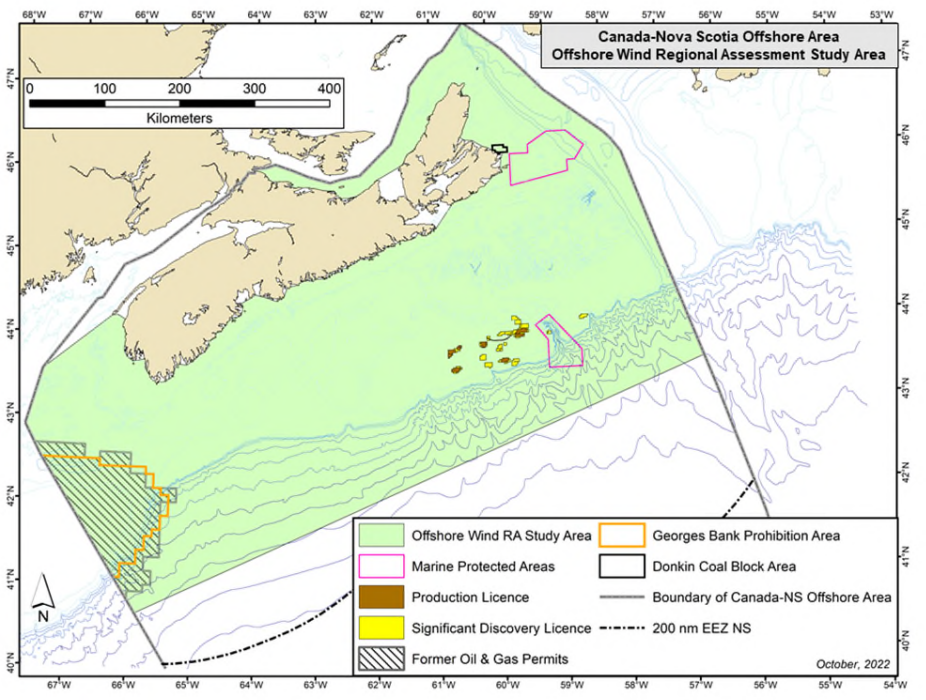

Below are the proposed study areas for each Regional Impact Assessment[2]:

For more information on the offshore wind Regional Assessments, please see our previous Thought Leadership piece, “Federal Government, Nova Scotia, and Newfoundland and Labrador clearing the way for offshore wind development”.

Sadira Jan is a partner in the Halifax office, with a practice focusing on renewable energy, financing transactions, mergers and acquisitions, as well as general corporate law. Sadie has extensive experience acting as lead counsel for onshore wind development projects and acts in the development, implementation and testing of tidal power in Atlantic Canada. She has been recognized by Lexpert in Energy law (electricity).

Dave Randell is a partner in the Halifax office, with extensive experience across various industries including energy, insurance, mining, media, manufacturing and technology. He has acted as lead advisor for a number of noteworthy Canadian and international clients in the energy sector.

James Gamblin is an associate in the Halifax office, with a practice in the areas of renewable energy, leasing, mergers and acquisitions and general corporate law. Jamie’s practice focuses advising clients regarding legislative and regulatory compliance. Jamie has a policy background, and holds Master’s degree in Public Policy and Public Administration.

This update is intended for general information only. If you have any questions on the above we would invite you to contact the authors or any other member of our Energy Group.

Click here to subscribe to Stewart McKelvey Thought Leadership.

[1] Impact Assessment Agency of Canada, “Public Notice: Regional Assessment of Offshore Wind Development in Newfoundland and Labrador and Nova Scotia.” Online: https://iaac-aeic.gc.ca/050/evaluations/document/145237?culture=en-CA

[2] Impact Assessment Agency of Canada, “Draft Agreement – Newfoundland and Labrador”, online: https://iaac-aeic.gc.ca/050/evaluations/document/145234?&culture=en-CA; Impact Assessment Agency of Canada, ”Draft Agreement – Nova Scotia”, online: https://iaac-aeic.gc.ca/050/evaluations/document/145235?&culture=en-CA

Archive

We are pleased to present the third installment of Beyond the border, a publication aimed at providing the latest information to clients about new programs and other immigration-related information that may be pertinent to employers of…

Read MoreHarold M. Smith, QC and G. John Samms Effective Monday, August 24, 2020, an order directing the mandatory wearing of masks, pursuant to the Public Health and Protection Act and the Special Measures Orders made…

Read MoreGerald McMackin, QC and Christopher Marr, TEP New Brunswick joined the rest of Canada in enacting legislation that deals solely with powers of attorney when the Enduring Powers of Attorney Act (“Act”) came into force…

Read MoreMurray Murphy, QC, CPHR and Kate Jurgens Three new bills have been introduced in the most recent sitting of the Prince Edward Island legislature. In the employment setting Bill 38 aims to address the prevalence…

Read MoreJennifer Taylor The Supreme Court of Canada has finally put an end to the “waiver of tort” debate. After years of uncertainty, a majority of the Court confirmed in Atlantic Lottery Corp Inc…

Read MoreStephen Penney and Justin Hewitt As municipalities begin opening up recreational facilities in Alert Level 2 of the COVID-19 public health emergency implemented by the Provincial Government, Municipalities Newfoundland and Labrador has been receiving inquiries…

Read MoreThere is no obligation upon a municipality to reduce a business tax due to limited operations secondary to the COVID-19 pandemic. A municipality does, however, have the discretion to offer business tax relief. If a…

Read MoreRuth Trask and John Samms Newfoundland and Labrador employers who continued operations this spring during Alert Levels 4 and 5 of the COVID-19 pandemic should take note of a new program offered by the provincial…

Read MoreChristopher Marr, TEP & Lauren Henderson As defined benefit pension plans (“DB Plans”) throughout Canada continue to face funding challenges due to mounting solvency deficits, the New Brunswick Financial and Consumer Services Commission (“FCNB”) is…

Read MoreJennifer Taylor The Supreme Court of Nova Scotia has acknowledged the ongoing impact of systemic racism against African Nova Scotians in an important decision on the Land Titles Clarification Act (“LTCA”). The case,…

Read More