COVID-19 FAQ & Checklist

Chad Sullivan and Clarence Bennett

As many employers resume operations during the ongoing pandemic, we have prepared a list of FAQs and a reopening checklist for businesses operating in Atlantic Canada.

- Do employers need to have a written plan for reopening?

Some provinces have made it mandatory to develop a COVID-19 operational plan before reopening.

For businesses operating or planning to operate in New Brunswick and Prince Edward Island employers must develop a plan outlining how daily operations will be managed to meet certain requirements such as physical distancing, hand and respiratory hygiene, pre-screening for symptoms, required signage and precautionary measures.

- WorkSafeNB has produced a draft operational plan which can be accessed here.

- PEI has published a template plan which can be accessed here.

Employers do not need to submit their plans for approval ahead of time (e.g. to worksafe or public health) but the plan must be made available upon request by a government official.

Newfoundland and Labrador and Nova Scotia have both recommended that businesses develop a business continuity or emergency plan but have not made such a plan mandatory.

When developing policies, procedures, training and communication materials, workplaces should use current, correct messaging from a trusted source.

It is best to follow federal, provincial and local government public health and workplace guidance. Some of the guidelines for the Atlantic Provinces can be found here:

- New Brunswick

- Link to WorkSafeNB guidelines can be accessed here including WorkSafeNB’s most recent guideline – “Embracing the new normal as we return safely to work” and its FAQ section of its website (which is frequently updated).

- Link to NB’s Public Health’s website can be accessed here which includes a link to an “Operational Plan Guide” and posters to be displayed in businesses that are operating during the pandemic.

- Prince Edward Island

- Nova Scotia

- Newfoundland and Labrador

Employers that operate across various provinces will have to ensure that specific requirements imposed by each province are followed.

- How does an employer recall those employees that were placed on temporary layoff?

While not required in each province, it is recommended that employers issue written notices of recall. Such notices should specify the date upon which the employee is expected to return and outline the consequences if an employee does not return within that timeframe.

Employees should be given as much notice of recall as reasonably possible (e.g. a week, if possible), so that they have sufficient time to organize their affairs.

In the recall notice, the employer should remind recalled employees that if they are collecting the Canada Emergency Response Benefit (“CERB”) or Employment Insurance (“EI”), they are required to inform the federal government of their recall, and that income they receive upon being recalled may impact their ability to continue to receive CERB or EI.

If another recall notice procedure is set out in employment agreements, a workplace policy or, if applicable, a collective agreement, the employer should follow that recall procedure. If no recall procedure is set out, the employer should require employees to return to work within a reasonable time after being requested to do so.

- What if an employer does not recall employees before the statutory deadline?

Of the Atlantic provinces, only Newfoundland and Labrador has a statutory deadline for recalling employees from a temporary layoff. In Newfoundland and Labrador, if temporary layoff exceeds 13 weeks in a 20 week period, it will be deemed a termination, triggering the obligation to provide severance pay.

However in each province, including Newfoundland and Labrador, if the termination is a result of an economic or climatic conditions beyond the foreseeable control of the employer then no termination pay is likely required.

Having said that, if a business reopens and recalls some employees but not others, there will likely come a time when the Labour Board or a Court will hold that an employee’s employment was terminated. It remains to be seen whether employers will be able to claim frustration of contract, etc. in defence of such claims. Further, the strength of such law suits / employment standards complaints will depend on the factual circumstances in any given case. You should receive legal advice when deciding whether or not to recall certain employees.

- When recalling employees from layoff, does an employer need to recall by seniority or by order of layoff?

There is no requirement to be recalled by seniority or order of layoff unless the employee works in a unionized workplace (or an employment contract stipulates rights on recall).

In unionized workplaces, the employer should look to the operating Collective Agreement to determine order of recall.

In a non-union environment (and in the absence of an employment contract stipulating order of recall) employers are free to choose who comes back and in which order. However, employers must be mindful of human rights claims (e.g. complaints based on family status or age) when making these decisions. Employers must use non-discriminatory and objective criteria.

- Can an employer top up an employee’s EI benefits while the employee is laid off?

An employer may register a Supplemental Unemployment Benefit (“SUB”) plan with Service Canada to provide supplemental payments to an employee during a period of unemployment due to a temporary stoppage of work, training, illness, injury or quarantine. Payments to an employee through a registered SUB plan are not deducted from the employees’ weekly EI benefits, thereby increasing their weekly earnings during a period of unemployment.

The plan must be registered with Service Canada or the payments will be deducted from the employees’ weekly EI benefits. An employer may ‘top up’ the employee’s EI benefits to a maximum of 95% of an employee’s normal weekly earnings.

An employer may also offer supplemental payments to maternity, parental or caregiving benefits but these plans do not need to be registered. These top up benefits will not be deducted from EI benefits, even if the plan is not registered.

- Can an employer retroactively pay employees who are being recalled from layoff in order to collect the Canada Emergency Wage Subsidy?

As part of its efforts to assist employers affected by COVID-19, the federal government implemented the Canada Emergency Wage Subsidy (“CEWS”). CEWS provides eligible businesses with a subsidy of 75% of employee wages for up to 24 weeks, retroactive from March 15, 2020 to August 29, 2020.

If an employer wishes to retroactively pay employees who are recalled for the time they were on layoff, the employer may be able to claim the CEWS for one or more of the following claim periods:

- March 15, 2020 – April 11, 2020;

- April 12, 2020 – May 9, 2020; and

- May 10, 2020 – June 6, 2020.

The employees must be rehired and paid prior to claiming CEWS.

Employers should be aware, however, that if an employee has received the CERB benefit and that employee is retroactively hired and paid for that period, the employee may be required to return or repay the CERB benefit.

- Can employees continue to receive EI benefits after they have been recalled?

In some cases, an employee may be able to continue receiving some EI benefits even if they have been recalled through the federal government’s Working While on Claim program.

For employees receiving regular EI benefits (as opposed to CERB), if the employee earns money while receiving EI benefits, they may retain 50 cents of their benefits for every dollar they earn, up to 90% of their previous weekly earnings (roughly four and a half days work).

Above 90%, EI benefits are deducted dollar-for-dollar. If the employee works a full week, they are not eligible to receive EI benefits, regardless of the amount they earn. However, this does not reduce the total number of weeks payable on the employee’s claim.

For employees who are receiving CERB benefits, see below.

- Can employees continue to receive CERB benefits after they have been recalled?

The CERB program is a federal government program that provides income support for employees who have been laid off or terminated as a result of COVID-19. CERB provides eligible employees with a $2,000 payment every four weeks for a period of up to 16 weeks. These periods are set by the federal government.

Employees who applied for EI benefits after March 15, 2020 are automatically redirected to CERB and, if eligible, will receive $500 per week regardless of what they may have been entitled to through EI.

Employees who are recalled may be required to repay their CERB benefits if they earn employment income over the following thresholds:

- If recalled during first four-week benefit period – employee will need to repay their CERB benefit if they receive more than $1,000 from employment income for a period of two consecutive weeks in the four-week period; or

- If recalled during a subsequent four-week benefit period – employee will need to repay their CERB benefit if they receive more than $1,000 from employment income during the entire four-week period.

Employees must re-apply for each four week period they are seeking the CERB benefit. If the employee chooses not to apply for CERB during a four week period because they have earned more than $1,000 in the four week period, the employee may apply for subsequent four week period if they are no longer earning more than $1,000.

- How does the Work-Sharing program work?

The federal government’s Work-Sharing program is an adjustment program designed to help employers avoid layoffs when there is a temporary reduction in the normal level of business activity beyond the control of the employer. The program provides income support to employees who are eligible for EI and who are temporarily working a reduced work week while their employer recovers from a reduction in business out of their control. The Work-Sharing program is a three-party agreement involving employers, employees and Service Canada.

The program allows a group of employees with similar job duties to agree to reduce their hours of work over specific period of time and to share the available work equally among themselves. The group of employees must reduce its hours by at least 10% – 60% to qualify and must be employees that are “core staff” – meaning they are needed to carry out the day-to-day functions of the business. Additionally, in response to COVID-19, employees considered essential to the recovery and viability of the business will qualify.

The employer and the employees must agree and apply to the Work-Sharing program together. The application must be submitted a minimum of 30 days prior to the requested start date and the Work-Sharing arrangement must be a minimum duration of six weeks. The employer continues to pay employees for the hours they have worked and Service Canada will pay employees a percentage of their EI benefit rate that corresponds with the percentage of work hours they missed. Even though general EI applications are currently being redirected and processed through the CERB, EI applications under a Work-Sharing program will continue to be processed through the standard EI rules.

As a result of COVID-19, the government has introduced a number of temporary measures to allow more businesses to qualify. Effective March 15, 2020 to March 14, 2020, the government has temporarily extended the maximum duration of Work-Sharing agreements from 38 weeks to 76 weeks for those businesses affected by COVID-19. Employers who have only been in business for one year are also now eligible (as opposed to the minimum two year requirement) and do not need to provide sales/production figures at the same time. The government has also waived the mandatory cooling off period for employers so that eligible employers may immediately enter into a new agreement.

Employers should be aware that any benefits received by employees through the Work-Sharing program will reduce the benefit that the employer is entitled to receive under CEWS.

- Can an employee refuse to work because of concerns regarding COVID-19?

There is no single method for dealing with an employee’s refusal to work in light of COVID-19, and as such, each situation must be dealt with on a case-by-case basis.

Employers must first communicate with the employee to determine the cause for concern. For example, is it due to an underlying health condition rendering the employee at risk? Is it a lack of childcare options due to schools remaining closed? Is it a true work refusal within the meaning of applicable occupational health and safety legislation?

Once the nature of the concern is understood, the employer will be required to, if applicable:

- (i) Provide the appropriate statutory leave of absence;

- (ii) Activate the work refusal process pursuant to occupational health and safety legislation;

- (iii) Accommodate the employee to the point of undue hardship, as required by human rights legislation.

If the employee’s concern falls outside of these protected areas and is simply a preference not to attend at work, other strategies for ensuring attendance must be considered. Generally speaking, a fear of contracting COVID-19 in itself will not suffice and employees can be forced to return to work or risk being subject to discipline and losing their CERB or EI benefits.

It’s important to obtain legal advice when faced with an employee refusing to return to work.

- How should an occupational health and safety work refusal be handled?

As provincial governments begin to implement a gradual return to work process, employers should be mindful of their rights and obligations in the event that an employee refuses to attend the workplace due to a fear that they may contract COVID-19 at work.

The OHS legislation in each Atlantic province establishes its own mandatory process for dealing with work refusals. At a high level, the process generally begins by the employee reporting the refusal to the company (e.g. to their supervisor), and then the employer must investigate and take any necessary remedial action. If this does not resolve the employee’s refusal, then the matter will need to be escalated to the OHS committee and/or applicable government OHS agency (depending on the province). Where the matter is referred to the applicable government OHS agency, an officer will investigate and make a binding determination.

If a government appointed investigator becomes involved, the investigator will likely do one of three things:

- Find that the employment environment is unsafe which may lead to an order to cease operations;

- Find that the work environment is safe; or

- Find that the employer must take some sort of corrective action (e.g. install a physical barrier).

If number two occurs (or three occurs and the employer undertakes the corrective action suggested) the employee will no longer be able to refuse to come to work without the threat of being subject to discipline (including up to termination) and potentially losing their CERB or EI benefits.

In light of the current pandemic, employers are strongly encouraged to follow provincial guidelines for steps to take to reduce the risk of transmission of COVID-19 in the workplace. While each circumstance must be assessed on a case-by-case basis, where employers follow all guidelines by public health authorities, existing case law stemming from work refusals in connection with the 2002-2004 SARS outbreak suggest that an adjudicator will look favourably upon an employer that can demonstrate that it relied on guidance from public health authorities in maintaining a safe environment to work.

- Can an employee demand personal protective equipment (PPE) or other accommodations before returning to work?

As employers begin recalling employees, employers should consider engineering controls (i.e. physical distancing and physical barriers), administrative controls (i.e. adjusting policies and procedures to reduce risk), and the use of PPE.

Employers are required to provide PPE such as non-medical masks if both physical distancing and physical barriers are not possible.

In other instances where an employee is requesting PPE, it may be that they have an underlying health condition triggering the duty to accommodate. This requires an individualized approach.

Masks are becoming more and more part of the “new normal” where physical distancing is not possible (both in and out of the workplace).

- What if some employees are not able to return to work because of child care obligations or they are caring for someone infected with COVID-19?

Generally speaking, in the event an employee cannot return to work due to having to care for children or a family member infected with COVID-19, employers will likely be required to provide time off without pay – or at the very least will have to explore options with the employee.

Newfoundland and Labrador and New Brunswick have enacted emergency leave regulations in response to COVID-19. Both provide for an unpaid leave of absence if the employee needs to provide care for a person for a reason related to COVID-19, including school and child care facilities being closed.

Nova Scotia has pre-existing emergency leave provisions in its Labour Standards Code providing an unpaid leave of absence in the event of emergency, including where there is an emergency declared under the Emergency Management Act that prevents an employee from performing the employee’s work duties and includes situations where the employee must care for a family member due to the emergency.

PEI has yet to enact any special leave provisions in response to COVID-19.

Further, family status is a protected ground in each of the Atlantic Provinces’ human rights legislation. If the employee cannot work due to family care obligations in light of COVID-19, the employer may have to accommodate to the point of undue hardship. Options for employers may include reducing hours or providing alternative shifts so that the employee may meet their family care obligations.

- What if some employees have underlying health conditions and are “at risk”?

Some provinces have introduced specific job-protected leaves in the context of COVID-19, and in particular, for individuals who are required to self-isolate for various reasons. For instance, in New Brunswick, an employee may be entitled to leave if required to quarantine/isolate on the advice of a health practitioner. Similarly, in Newfoundland and Labrador, an employee may be entitled to leave if under medical investigation, supervision, or treatment due to COVID-19.

The emergency provisions of Nova Scotia’s Labour Standards Code are quite broad, and allow for a leave of absence in the event of an emergency. If an employee intends to take emergency leave he/she must give the employer as much notice as reasonably possible, along with evidence that the employee is entitled to the leave.

Further, physical disability is a protected ground in each province’s human rights legislation. As such, where an employee has an underlying health condition that could increase their risk to become infected, or which may lead to severe complications, then this may give rise to the employer’s duty to accommodate the employee on the basis of disability if the underlying health risk itself constitutes a disability within the meaning of human rights legislation.

If accommodation is required, the employer must accommodate to the point of undue hardship. This may include allowing the employee to work from home, reassigning the employee to a safer working environment or providing the employee with a leave of absence (with or without pay).

- Can an employee refuse to return to work based on concerns about utilizing public transportation to commute to work?

The employer’s duty to ensure the health, safety and welfare of workers does not extend beyond the workplace. However, if an employee has an underlying health condition which could increase their risk of a severe reaction if they contract COVID-19, an employer may have a duty to accommodate the employee if the health condition constitutes a disability under applicable human rights legislation.

Where the duty to accommodate is triggered, an employer must accommodate to the point of undue hardship which, for an employee without access to private transportation and who has (or has a family member with) an underlying health condition, may include:

- Altering the employee’s start and end times to avoid peak travel times on public transportation;

- Allowing the employee to continue working from home where possible; or

- Providing unpaid leave.

Generally speaking, if an employee is worried about use of public transportation without any evidence of a particular risk to the employee, an employer would likely not be required to accommodate the individual.

- Can an employer require that employees wear face masks/coverings when working?

An employer may require that employees wear face masks or other face coverings if they are necessary to reduce the risk of transmission in the workplace – and in fact employers may be required to do so where physical distancing is not possible.

Generally, face masks are to be used as a last resort where other measures changing the work environment and maintaining physical distancing is not possible or installing physical barriers between staff is not feasible.

In New Brunswick, WorkSafeNB has stated that if employers cannot ensure two meter distancing, employees must wear face coverings and the employer must provide them.

In the other Atlantic provinces, it is strongly recommended that employees wear non-medical masks if employees cannot maintain physical distancing. The PEI government provides the following recommendations on wearing non-medical masks in the workplace:

If non-medical masks or face coverings are used in the workplace, they should not:

-

- Be worn for extended periods of time

- Be made of plastic or other non-breathable materials

- Be made exclusively of materials that easily fall apart, such as tissues

- Be secured with tape or other inappropriate materials

- Be shared with others

- Impair vision or interfere with tasks, or otherwise pose a hazard to the employee while working

The misuse of PPE can increase risk of infection. Employers must ensure that employees are properly trained on physical distancing, hand hygiene, PPE and all other safety measures related to COVID-19.

- Can an employer conduct temperature screening prior to entering the workplace?

Under occupational health and safety laws, an employer has an obligation to take reasonable steps to protect the health and safety of its employees. This includes taking all reasonable steps to prevent persons who exhibit symptoms of COVID-19 from entering the workplace. Some screening measures typically discouraged due to privacy concerns may now be permitted given the exceptional circumstances of COVID-19.

Temperature screening is one measure which is being considered by employers. Temperature screening typically involves using touchless temperature scanners to detect body temperatures over 38 degrees Celsius which is one symptom of COVID-19.

In New Brunswick, WorkSafeNB has made temperature screening mandatory in situations where physical distancing is not possible. WorkSafeNB provides the following guidelines on temperature checks:

Employees must give informed and voluntary consent before an employer can take and record their temperature.

To help ensure that their temperature is taken accurately, consider asking a trained medical professional to take temperatures if one is available on site. The medical professional may also train others to take temperatures. The training should be documented.

If there are no trained medical professionals on site, the employer should designate one or more management-level personnel to take temperatures. This individual should review the directions to use the thermometer or scanning equipment to ensure proper use. That individual should also be trained, and the training process should be documented.

If the temperature is being recorded, employees may also be concerned about the privacy of this data. Only record the information that is necessary. The information collected when taking the temperature must be kept confidential and in a secure location. Access to the information should be limited to those who need the information to make decisions. Employees should be informed that employers may need to disclose the information to Public Health, if the employee’s temperature is above 38oC. Employees should also be informed of the process to access their records. It is best to keep a digital copy of the data with secured access. The information should be destroyed once the outbreak is over. Communicate the steps taken to keep the data private with employees.

Despite these efforts, an employee may refuse to have their temperature taken. Though the employee has this right, the employer must ensure that they are taking every reasonable precaution to ensure the health and safety of all employees in the workplace. The employee should be informed that if they refuse to have their temperature taken, the employer can refuse their entry into the workplace. The employer would not be obligated to pay an employee after such a refusal.

At the moment, New Brunswick is alone in mandating temperature checks for workplaces where physical distancing is not possible. However, temperature testing in other provinces may be justified during the pandemic – particularly for employers that serve vulnerable populations. Employers should seek legal advice prior to implementing temperature testing.

- Can an employee refuse to submit to a screening measure?

Prior to instituting screening measures, employers should develop applicable policies and distribute them to employees. The policies should explain the need for the screening, the type of screening being conducted, and the consequences for failing a screening measure or refusing to be screened.

If an employee refuses to be screened, the employer should attempt to better understand the reason for refusal. If no resolution is reached, the employee may be refused from the workplace without pay.

- Are employees able to seek workers’ compensation benefits should they contract COVID-19 in the workplace?

Most cases of COVID-19 are not work-related. However, if an employee contracts COVID-19 in the workplace, they may be entitled to workers’ compensation benefits. The employee will have to prove that they contracted COVID-19 as a result of being exposed to the virus in the workplace.

In determining whether an employee contracted COVID-19 in the workplace, the following factors may be considered by the applicable workers’ compensation board:

- Nature of the worker’s employment;

- Work environment and processes;

- Job tasks;

- Preventive measures put in place by the employer including the use of PPE, if deemed necessary; and

- Risk of transmission of COVID-19 in the workplace.

Provincial workers’ compensation authorities are clear in that they will not approve claims of workers who cannot work for preventative or precautionary reasons, such as self-isolation or quarantine.

- What happens if an employee tests positive for COVID-19?

Each provincial public health authority will be the first to know if and when an employee tests positive for COVID-19. In such cases, the health authority will determine if there is a need to inform the employer of the test results. In New Brunswick, if an employee tests positive for COVID-19, the employer must cooperate Public Health and report the exposure to WorkSafe NB.

In Newfoundland and Labrador, the Personal Health Information Act prevents Public Health from releasing a patient’s name to an employer. In those cases, Public Health would contact individuals who may have been exposed to COVID-19 and advise accordingly.

- Are employees allowed to travel between provinces for work?

The Province of Nova Scotia, under the authority of the Health Protection Act, requires anyone who has travelled outside Nova Scotia to self-isolate for 14 days from the day they return to the province, even if they do not have symptoms. Essential workers, as well as healthy workers who regularly cross the Nova Scotia land border to travel to and from work, are exempt from the requirement to self-isolate.

The New Brunswick government has maintained the restrictions on travel across borders and requires all person entering the province to be pre-approved by policy. New Brunswick residents returning from outside the province and persons permanently relocating to New Brunswick are permitted entry but must follow the guidance of the Chief Medical Officer of Health, including self-isolation for fourteen days.

Essential workers and workers who live in or near an interprovincial border community and who commute to and from work in the other province, who are healthy, are not required to self-isolate if they are travelling directly to and from work within NB.

For employers who are employing workers who must travel from outside NB, the employer must either:

- Ensure the worker self-isolates within NB for 14 days after arriving, does not leave their isolation site, and follows the WorkSafeNB and Public Health guidelines before and after entering any workplace; or

- Submit to WorkSafeNB, a minimum of 15 days in advance of expected worker arrival in the province, and receive prior approval of the isolation elements of the employer’s Operational Plan for interprovincial workers which must ensure that non-NB workers are, for fourteen days after they enter the province:

- Isolated from any New Brunswicker while they travel to and from their accommodations and worksite;

- Not in contact with any New Brunswicker during work hours and while off duty;

- Effectively supervised to ensure these isolation measures are met; and

- Compliant with any requirements set out by the Chief Medical Officer of Health or WorkSafeNB.

The Renewed and revised Mandatory Order COVID-19 (May 8, 2020) states that no temporary foreign worker is permitted to enter NB. However, the order now confirms that this does not impact those holding a work permit issue in relation to a nomination of permanent residence through the NB Provincial Nominee Program or the Atlantic Immigration Pilot.

On April 30, 2020, the Newfoundland and Labrador government made an order pursuant to section 28 of the Public Health Protection and Promotion Act, prohibiting individuals from entering Newfoundland and Labrador, with few exceptions, effective as of May 4, 2020.

On May 5, 2020, the Chief Medical Officer of Health signed a Special Measures Order (Travel Exemption Order) that makes various exemptions to the prohibition of entering the province, including individuals who:

- Are visiting a family member who is critically or terminally ill, or to care for a family member who is elderly or who has a disability;

- Have a significant injury, condition or illness and require support of family members resident in the province;

- Are permanently relocating to the province;

- Are recently unemployed and will be living with family members in the province;

- Will fulfill a short term work contract, education internship or placement;

- Are returning to the province after completion of a school term out of province; and

- Are complying with custody, access, or adoption orders or agreements (including a child/children arriving in the province and individuals accompanying the child/children).

These persons must make a formal request to the Chief Medical Officer of Health to benefit from the exemption.

In PEI, all non-essential travel is prohibited. In order to gain entry into PEI, travellers may submit a request for a pre-travel approval letter. The letter is available for:

- Residents of other provinces who must enter PEI to work in essential services; (also required letter from employer indicating area of essential services);

- Persons entering the province for emergency medical purposes, including patients and persons necessary to travel with patients, and person accompanying animals for emergency services at the Atlantic Veterinary College; recommend (letter from Doctor or proof of appointment);

- Residents of the province of Quebec transiting to or from Magdalen Islands; (letter from the Province of Quebec); and

- Person exercising or facilitating custody and / or access with children.

Temporary foreign workers are still permitted to travel to and work in Nova Scotia. The Nova Scotia government has set out guidelines for temporary foreign workers employed in the agriculture and seafood industries. Temporary foreign workers must abide by all regulations set out by the federal and provincial government.

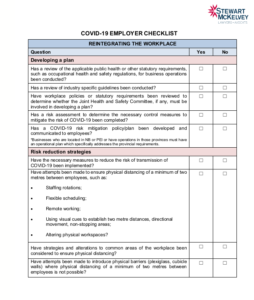

Click below for a reopening checklist for employers:

This article is provided for general information only. If you have any questions about the above, please contact a member of our Labour and Employment group.

Click here to subscribe to Stewart McKelvey Thought Leadership articles and updates.

Archive

IN THIS ISSUE: Putting Trust in your Estate Planning, by Paul Coxworthy and Michael McGonnell The Risks, for Insurers in Entering Administration Services Only (ASO) Contracts, by Tyana Caplan Angels in Atlantic Canada, by Allison McCarthy, Gavin Stuttard and Adam Bata…

Read MoreBill 31, An Act Respecting Human Rights, came into force on June 24, 2010 replacing the Human Rights Code (the “Code”). For more information, please download a copy of this client update.

Read MoreIN THIS ISSUE Expanded Fines and Penalties for Environmental Offences: The New Federal Environmental Enforcement Act Spam about to be Canned? Preparing a Business for Sale Business Disputes Corner – Place of Arbitration and Selected…

Read MoreThe Nova Scotia Court of Appeal has unanimously upheld the province’s legislative limits on general damage recovery for “minor injuries”. Today’s decision, authored by Chief Justice Michael MacDonald, completely affirms the January 2009 decision of…

Read MoreThe Canada Revenue Agency (“CRA”) announced helpful administrative positions concerning the new rules under the Fifth Protocol to the Canada-US Income Tax Convention, 1980 which will come into effect on January 1, 2010. The CRA…

Read MoreIN THIS ISSUE Contractor Held Liable for Business Interruption: Heyes v. City of Vancouver, 2009 BCSC 651 When Can a Tendering Authority Walk Away if Bids are Too High? Crown Paving Ltd. v. Newfoundland &…

Read MoreWithholding tax and other issues under the Fifth Protocol The Fifth Protocol to the Canada-US Tax Convention, 1980 introduced significant changes which may affect the use of most unlimited companies and other so-called ULCs. These…

Read MoreIN THIS ISSUE An Eye for an Eye: Alberta Court of Appeal Upholds Finding of Retaliation Liability as a Result of Generosity in Quebec Undue Hardship Established in Scent Case Parents of Twins Get Double…

Read More- « Previous

- 1

- …

- 62

- 63

- 64