You’re more essential than you think: it is crunch time for Newfoundland and Labrador employers to avail of Essential Worker Support Program

Ruth Trask and John Samms

Newfoundland and Labrador employers who continued operations this spring during Alert Levels 4 and 5 of the COVID-19 pandemic should take note of a new program offered by the provincial government that may provide extra wage supports.

The federal government pledged up to $3 billion in support to increase the wages of low-income essential workers across the country, leading the Newfoundland and Labrador government to create the Essential Worker Support Program (“EWSP”) to get this support into the hands of workers. You may not be aware of two key things: (1) the term “essential worker” is likely more broad than you expected; and (2) to avail of the program for their employees, employers must act soon.

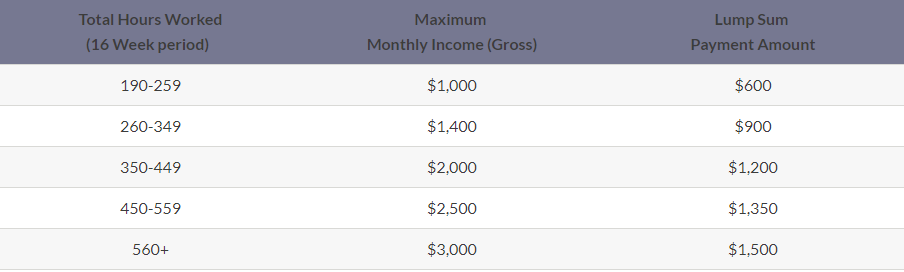

The program provides for a lump sum payment of up to $1,500 for each essential worker who meets the eligibility criteria. The employer must apply on their behalf and upon a successful application, the funds funnel from the government, to the employer, and finally to the employee. Employers are eligible to receive an additional 10 percent of the total employee benefit, which is meant to cover its mandatory employment-related costs such as the employer’s share of CPP and EI remittances.

The eligibility period is for workers who worked from March 15 to July 4, 2020. The eligible benefit amounts are explained as follows on the government webpage:¹

You’re more essential than you think

Newfoundland and Labrador has followed the federal government’s lead in establishing a broad range of “essential” services which qualify for the EWSP program. If your business services fall within this group and you operated during Alert Levels 4 and 5, your business may be able to apply, even if you were operating only at a reduced capacity between March 15 and July 4.

The requirements are that an eligible essential worker must:

- Be a resident of Newfoundland and Labrador and legally authorized to work in Canada;

- Be employed or self-employed in any business or organization providing ‘essential services’ as defined by Essential Worker Listing;

- Have not received the Canadian Emergency Response Benefit (CERB) during the eligibility period;

- Have worked in both Alert Levels 4 and 5;

- Have gross earnings less than $3,000 in a month during the program eligibility period; and

- Have worked a minimum of 190 hours during the program eligibility period.

Importantly, the definition of “essential services” is quite broad, as it is “any business” providing essential services as defined by the Essential Worker Listing in the following sectors:

- Energy and Utilities

- Information and Communication Technologies

- Finance

- Health

- Food

- Water

- Transportation

- Safety

- Government

- Manufacturing

The listing at the link above provides further detailed guidance in relation to those specific sectors. Employers will need to carefully inspect this guidance document to ensure they fit within its parameters, but it is worth considering for most employers who employ eligible employees as described above. Employers are required to certify in a declaration that their employees are eligible for EWSP, which may require you to work with your employees to confirm the necessary information.

It’s crunch time

To avail of this program for your employees, employers should act fast. There is a two-step registration process. First, employers have to register to be set up as a government vendor and then complete one’s registration as an Essential Worker Employer. Government recommended that this portion of the registration process be complete before June 30, 2020, but it is not too late to apply now. Employers should start this process as soon as possible, and be mindful of the ultimate application deadline of July 30, 2020.

We are here to help

The EWSP could provide your employees with much-needed support and compensation for working during the early days of the COVID-19 pandemic, which is positive for employers and workers alike. We encourage you to review the criteria and consider applying if your employees are eligible. We would be pleased to assist you as you navigate the eligibility criteria, making the necessary inquiries of your employees and evaluating your payroll records, and completing the application process.

For more information and for access to the application forms, employers can also consult the government EWSP webpage here.

¹ https://www.gov.nl.ca/aesl/essential-workers-program/

This article is provided for general information only. If you have any questions about the above, please contact a member of our Labour and Employment group.

Click here to subscribe to Stewart McKelvey Thought Leadership articles and updates.

Archive

In preparing for the 2020 Proxy season, you should be aware of some of the regulatory developments and institutional investor guidance that is likely to impact disclosure to, and interactions with, shareholders. This update highlights…

Read MoreJennifer Thompson Nova Scotia’s Premier’s Office has today made an unexpected announcement regarding several changes to be made to Nova Scotia’s minimum wage and partial hours rules, with effect from April 1, 2020. Additional increase…

Read MoreKathleen Leighton For individuals whose Permanent Resident Cards (“PR Cards”) have expired, it can be a time of panic. “Did I lose my status?”, “Do I have to leave the country immediately?”, “Can I still…

Read MoreDante Manna The Nova Scotia Government is seeking input by way of public survey or written submissions on proposed changes to family property law that would, among other things, affect pension division between former spouses.…

Read MoreAtlantic Canada experienced a number of legal developments in 2019 that regional employers should be aware of as they plan for the year ahead. Click the image below to read our 2019 year in review,…

Read MoreG. Grant Machum & Richard Jordan On December 20, 2019, the Supreme Court of Canada released its decision in Canada Post Corporation v. Canadian Union of Postal Workers, 2019 SCC 67. This case involved a…

Read MoreLevel Chan and Dante Manna In this update we provide what we see on the employee benefits and pension plans legal horizon in 2020 and beyond, along with a review of some highlights from 2019.…

Read MoreJennifer Thompson The Accessible Canada Act (“Act”) came into force on July 11, 2019, ushering in the start of a march towards a Canada without barriers for persons with disabilities. While the Act only applies…

Read MoreKathleen Leighton If you employ an individual who holds a work permit to authorize their work in Canada, you likely have various obligations to adhere to and can face significant consequences if your business is…

Read MoreDavid Constantine and Joe Thorne In the recent Supreme Court of Canada decision in Desgagnés Transport Inc v Wärtsilä Canada Inc, 2019 SCC 58, the court examined how provincial statutes and the federal maritime law…

Read More