Estates & Trusts

Stewart McKelvey regularly acts for individuals, owner-managed and family businesses, trust companies, financial institutions and charitable entities on a wide range of estate and trust matters. We work in tandem with our clients’ other professional advisors to ensure a multi-disciplinary response to their needs.

Our team regularly advises clients in relation to:

- Estate and tax planning

- Estate administration and litigation

- Asset protection

- Charities and not-for-profit entities

- Probate planning

- Cross-border and international estate and trust planning

We provide our clients with strategic guidance and advice at all stages of the planning and administration process.

Our estate planning lawyers are experienced in tax to ensure our clients receive the best counsel possible on estate planning, business succession and trust and estate administration. We do everything we can to proactively create plans designed to avoid litigation.

We know, however, that there are times when disputes are unavoidable. Should matters become contentious, we will advance and defend claims involving challenges to wills and estates, claims under dependents’ relief legislation and similar matters.

Our experience:

- Design and implementation of estate plans involving tax-planned wills with multiple trusts, advanced probate planning mechanisms and strategies to address potential future incapacity.

- Administration of estates and trusts, and advice to executors, trustees, attorneys and guardians.

- Tax-planned corporate reorganizations involving family trusts, holding companies and similar planning structures.

- Contested estates and trusts claims, and related litigation involving estates, trusts and powers of attorney.

Insights

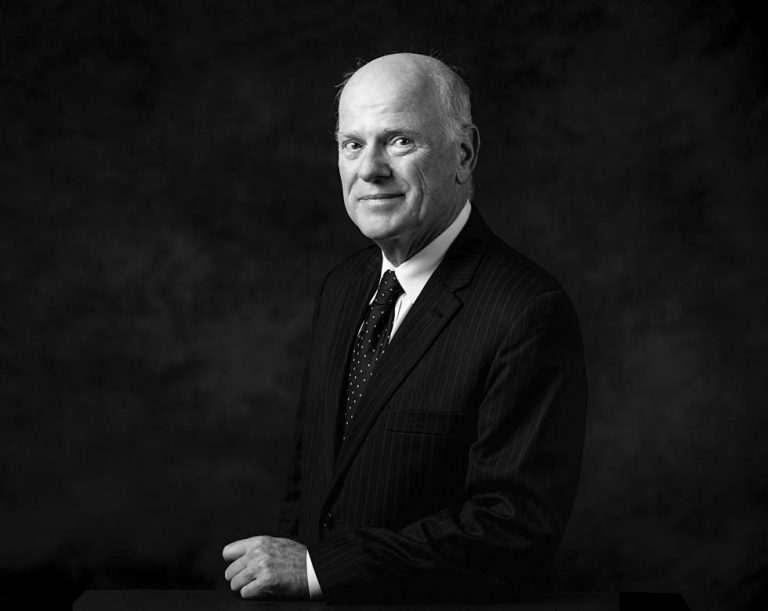

Associated Lawyers

- All

- Charlottetown

- Fredericton

- Halifax

- Moncton

- Saint John

- St. John's